Welcome to Insider Finance. If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

On the agenda today:

- Bank of America just announced a major leadership shuffle.

- The battle for talent in the mortgage industry is heating up.

- Dyal is eyeing more NBA deals after upping its stake in the Sacramento Kings.

Let's get started.

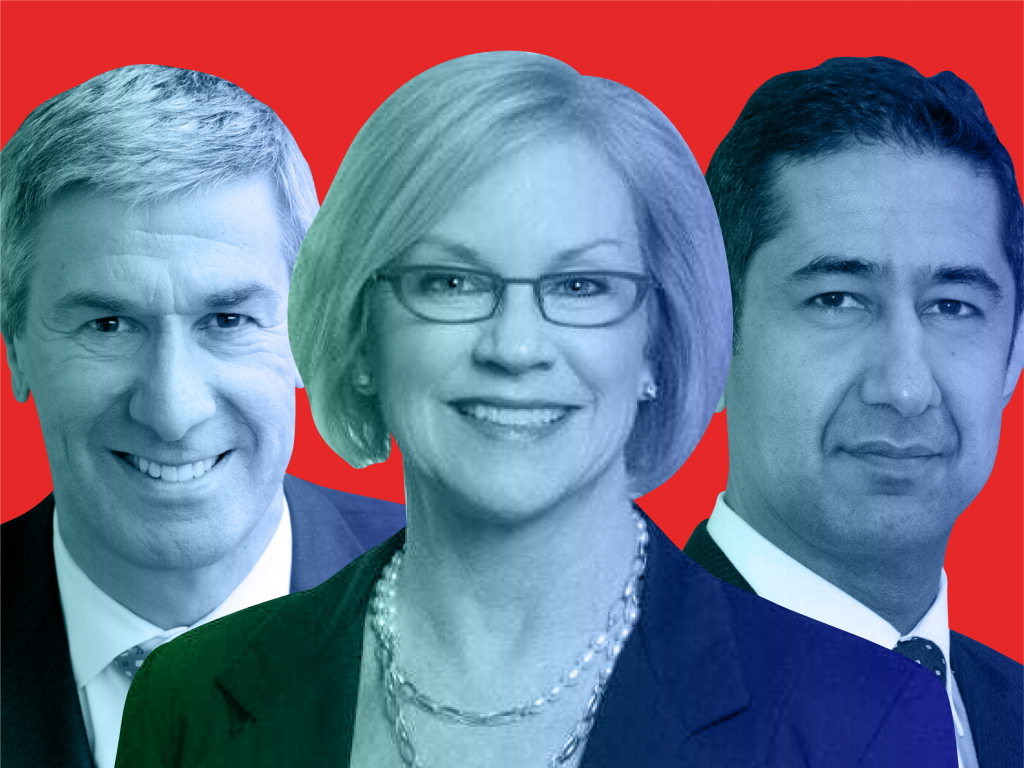

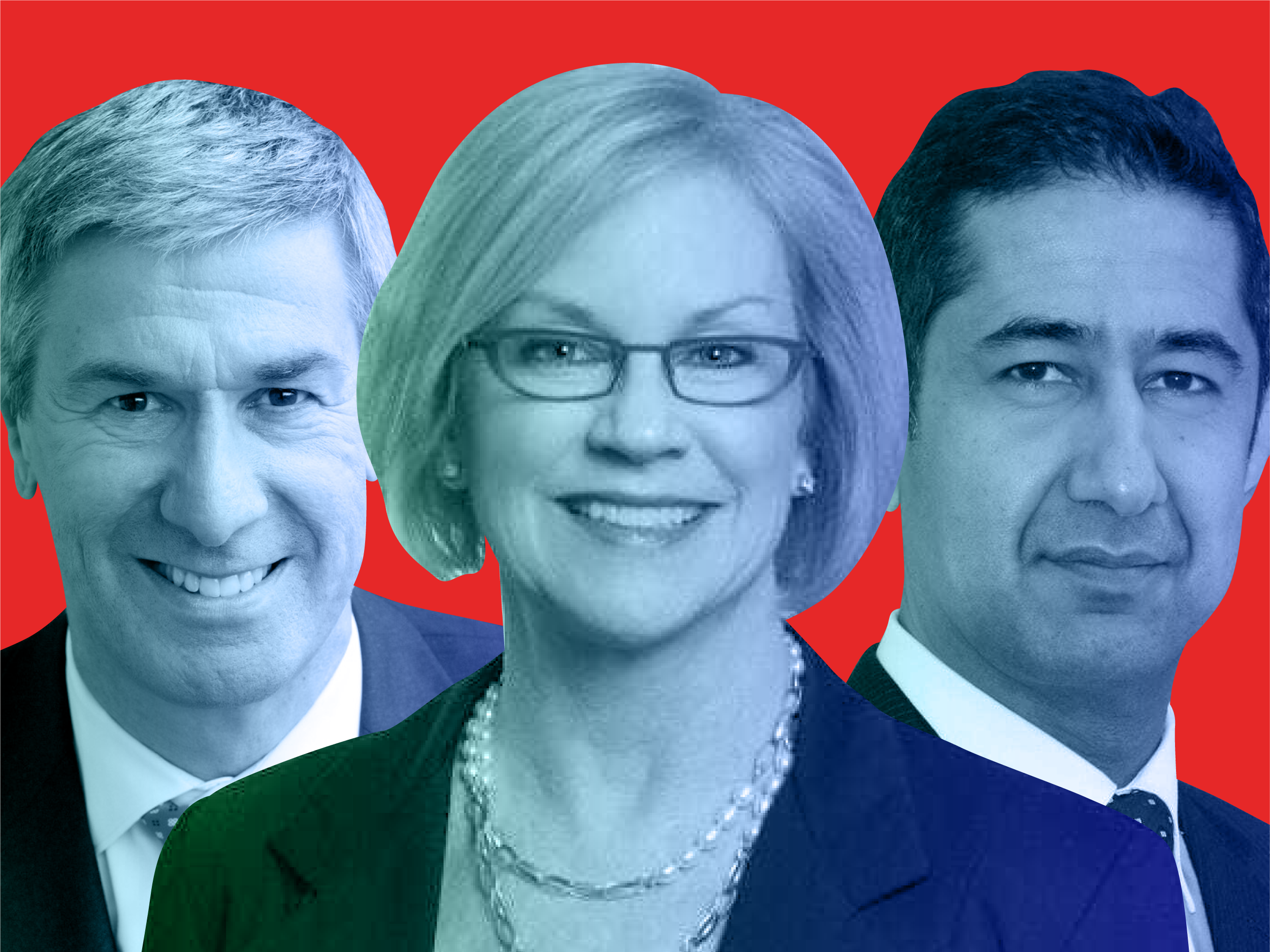

Bank of America is shaking up its top ranks

The bank just announced sweeping changes to its senior leadership team, including sunsetting the chief marketing officer title. In total, 15 execs are seeing their roles change, including Cathy Bessant, who had been chief technology and operations officer but was promoted to vice chair of global strategy. Her former role will be split in two, with new leaders overseeing the bank's tech and ops divisions.

Wall Street's pay raises could just be starting

Billionaire dealmaker Ken Moelis said the pay increases sweeping Wall Street could just be beginning - and that we could see another wave of raises for junior bankers in 2022. Here's what else he said.

Inside the mortgage industry's fierce battle for talent

Demand for home loans skyrocketed during the pandemic, and in turn, so has the demand for talent. Lenders are scrambling to acquire workers, including underwriters and loan officers - and one has even gone as far as offering a $50,000 signing bonus. More on the mortgage industry's staffing frenzy.

PE firm Dyal is on the hunt for more NBA deals

Dyal is taking a bigger stake in the Sacramento Kings, and is hungry for more. As professional sports teams' valuations soar, the private-equity firm is looking to invest in up to 12 franchises. Here's what we know so far.

One of the Tiger Global spin-outs had a big August

Neeraj Chandra's Untitled Investments, one of the newest additions to the extended Tiger family, is up 15.2% for the year after gaining 5% in August - even outpacing larger Tiger Cubs like Coatue and Lone Pine. Take a look at how the firm and its peers performed.

Wall Street is loving the housing crisis

Home affordability is under historic pressure - and some investment firms want to keep it that way. The national home shortage (and fading affordability) is stifling first-time buyers, while keeping investors' profits safe.

On our radar:

- We asked some of New York's biggest names in tech to nominate the city's top investors, and created a list of the 50 most influential VCs in the city. Meet them here.

- SkyBridge's Anthony Scaramucci is hosting the first in-person SALT conference since 2019, and attendees include Paris Hilton and Steve Cohen.

- The WSJ reports that crypto enthusiasts are borrowing cryptocurrency to buy houses, cars, and even more crypto.

- Digital-payments company Stripe is discussing a potential 2022 public listing with bankers, according to Bloomberg. What we know so far.

- Harvard University's $42 billion endowment will stop investing in the fossil fuel industry. Get the full rundown here.